Full-Service ADU Builder

From design to construction - we handle everything California ADU’s.

Serving Southern California Since 1985

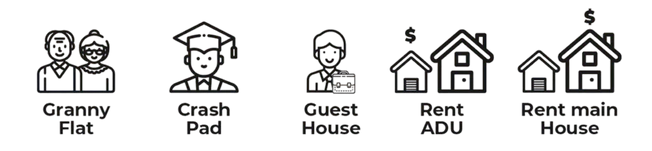

ADU’s For Every Need

From custom ADU’s to our pre-designed models, we build ADU’s for every need.

Our Work In Action

Plan, Design, & Build your ADU with Luctor Company.

ADU Value & Benefits

Turn your backyard into a second dwelling or new stream of income.

If you need more room or some extra income, new California laws make it easier than ever to build an ADU.

Value-Add of an ADU over 25 years

ADU Permits Issued in LA (2012-2020)

Our Build Process

From blueprinting to construction, we handle your ADU build from start to finish.

-

We get familiar with your ADU goals and needs and begin evaluating the scope, budget, and timeline.

-

There are many ways to finance your ADU. We work with you to find the right financing option.

Popular Financing Options:

HELOC: Flexible draws during design and build

Home Equity Loan: Fixed budget with predictable payments

Construction‑to‑Perm: One loan that converts to a mortgage after completion

Cash‑Out Refi: Replaces current mortgage, useful when rates and equity make sense

-

Custom or pre‑designed plans to fit your lot. From blueprinting to construction, we handle your project from start to finish.

-

We handle city approvals end‑to‑end.

-

Coordinated build with clear milestones.

-

Guidance on financing and handoff.

Get A Free ADU Quote

Contact our ADU team today!

Frequently Asked Questions

Got questions about ADU’s? We got answers.

-

The size can be from 400sq ft. to up to 1,200 sq ft. depending on city. There is typically a 5’ setback from property lines, unless the garage is being converted. There is no additional parking required if 1/2 miles from bus stop. Requirements vary by city.

-

HELOC, Home Equity Loan, Construction‑to‑Permanent (C2P), and Cash‑Out Refinance. Each fits different budgets, timelines, and risk preferences.

-

Yes. HELOCs and C2P loans often allow draws for soft costs like design, engineering, permits, and site surveys.

-

A HELOC provides a revolving line of credit with interest‑only payments during the draw period. Limits are commonly based on combined loan‑to‑value (CLTV), often up to around 80% depending on lender and profile.

-

Lenders add your current mortgage balance to the new loan amount and divide by your home’s appraised value. Many lenders cap that ratio near 80%, though criteria vary.

-

Requirements vary by lender and product. Stronger scores can unlock better rates and higher limits. Lenders evaluate credit history alongside DTI, equity, and income.

-

Government ID, recent pay stubs or income statements, W‑2s or tax returns for two years, bank statements, mortgage statement, homeowner’s insurance, and a preliminary ADU scope, budget, and timeline.

-

Often a few minutes to a few days, depending on product and documentation. Full underwriting takes longer and is affected by appraisal and title timelines.

-

Typically in stages aligned to milestones, via inspections or documentation. HELOCs offer flexible draws; C2P loans use a lender‑managed draw schedule.

-

Yes. Many homeowners fund design and build with a HELOC, then refinance into a fixed mortgage or C2P conversion after completion, subject to market rates and qualification.

-

Some do with conditions, often requiring leases, market rent schedules, or completion certificates. Policies vary; ask lenders about rental‑income treatment.

-

Luctor is not a lender. Some lending partners may have promotional or introductory offers from time to time. Final terms and rates come from licensed lenders.

-

A HELOC or second‑position home equity loan can preserve your existing first‑position rate. A cash‑out refi replaces it; weigh the trade‑offs.

-

Equity and appraisal value, CLTV caps, DTI, credit, and documented income all influence the maximum loan amount and structure.

-

Potential appraisal, origination, title/escrow, recording, inspection, and draw fees. HELOCs may have annual or inactivity fees. Ask lenders for a fee sheet.

-

HELOCs usually allow interest‑only payments during the draw period. C2P loans often require interest‑only on funds disbursed until conversion to a permanent mortgage.

-

Fixed‑rate home equity loans and many C2P products allow rate locks under specific timelines and conditions. HELOC rates are often variable; some offer fixed‑rate conversion options.

-

Lenders may order “as‑completed” appraisals that consider the post‑build value, using plans, specs, and budgets.

-

Choose products with flexible draw windows and confirm extension policies. Build contingency into your timeline and budget.

-

Generally yes. Product eligibility depends more on equity, DTI, and property type than ADU attachment, though some underwriting details may differ.

-

Many HELOCs and home equity loans have no prepayment penalties, but terms vary. Confirm with the lender before signing.

-

Second liens must be settled or subordinated at refi or sale. Discuss subordination and payoff scenarios with the lender.

-

Some homeowners use a small HELOC for early soft costs, then switch to C2P or refinance after completion. Coordinate timing, fees, and rate exposure.

-

Speak with a lender, get pre‑approved, submit full documentation, complete appraisal/title, receive draw approvals aligned to the build, and disburse funds as milestones are met.

-

Organize documents early, define a realistic scope and budget, and align your design, permitting, and construction milestones with your financing draw plan.